How to exit your start-up in the Middle East

How to exit your start-up in the Middle East

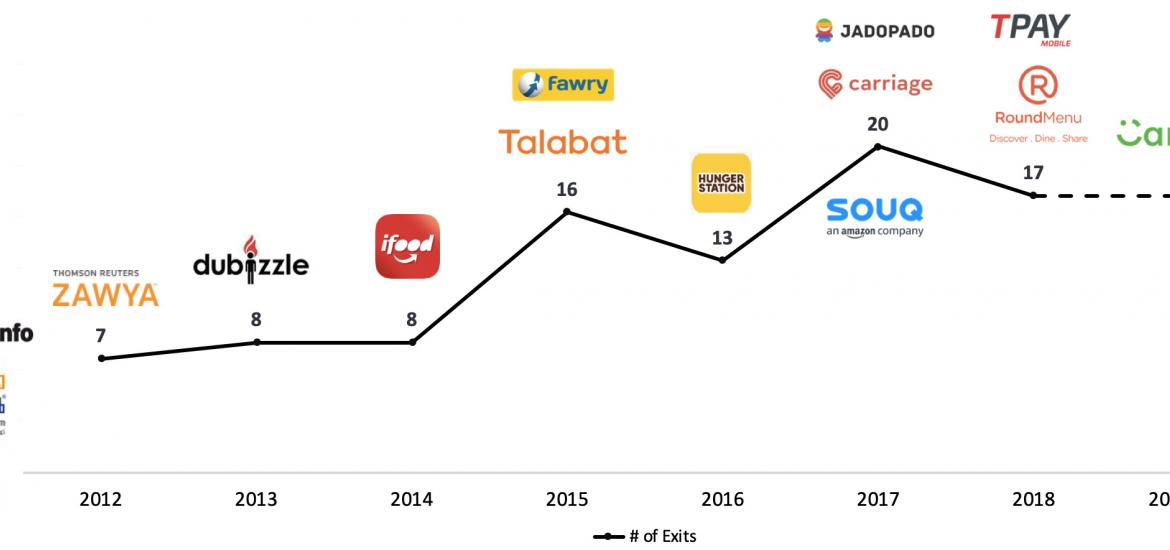

The number of exits is accelerating in the region, with yet another exit announced on August 7th, as Egypt-based muslim dating app Harmonica was acquired by US-based Match Group, the parent company of Tinder, Match.com and OkCupid, among others. In 2019 to date, there have already been 17 start-up exits in the region, with Dubai-based ride-hailing app Careem becoming the first unicorn exit through its acquisition by international rival Uber for $3.1B. Noor Sweid, founder and general partner at Global Ventures, shared her insights with MAGNiTT on what it takes to exit.

Not too long ago, people would start up a company with the vision of handing it down to generations of the family, or to become a permanent fixture in that industry.

Now, most, if not all, start-ups have the intention of eventually exiting – whether as an IPO, acquisition or merger. It’s the trend – for now.

Start-ups by definition are where things happen quickly with very few resources; they are either innovative or emulative, they are experimental and unstructured, with everyone creating value where they can.

But when a start-up is looking to exit, it needs to mature.

So how do you make a start-up attractive enough to be sought after, and how do you make sure that the innovation and energy that make it attractive don’t get weighed down and obliterated with the maturity and seriousness required for an exit?

In the MENA region, IPOs have not been very common, as few companies have been able to meet the listing requirements, including maintaining a minimum profit level over a certain number of years with consistent cash flow – keeping in mind that this is not the objectives of young tech companies.

Selling to private equity firms or major industry players has been more the trend in the region, with Amazon buying out Souq.com and Uber buying Careem, in line with global venture expectations where 70% of exits are industry M&A.

To consider a successful exit, you need to be in the zone of accelerated growth, you need to be in a position where you stand out among your competition and there is still future growth on the horizon; or you need to be a serious threat or an immense value-contributor to a bigger competitor. If you have all those going for you, it’s time to prepare for exit.

An exit strategy does not have to be a part of the initial plan of a start-up, but it does need to be part of the long-term plan of the founders. The key to a successful exit is to start the consideration of exiting at least two years before your intended exit time frame.

Within those two years there are certain key elements that need to be put into place and implemented; and you can start by asking yourself certain questions;

- What happens to your company if you are hit by a bus? Processes happen: If you don’t have processes, you don’t have a successful exit. Your company needs to have a proper corporate and managerial structure, there needs to be proper delegation and accountability structure, it needs to be able to stand on its own feet without you, and this makes it an attractive buy. This gives your company credibility and longevity beyond you, which is what the acquirer is searching for.

- Who makes the decisions and how? Governance: Where strategic aims, supervision, setting company values, transparency and accountability are ensured by a governance structure and authority matrix that are pre-determined and clear to all within the company.

- Who have you inspired? Team: As a founder with a vision, you need to have your team who you have inspired to join you and share your story. Your team needs to be capable, professional and able to create value for the acquirer; sometimes the team is the key to a successful sale.

- What would you look for as an acquirer? Put yourself in the acquirer’s shoes and take a step back and look at your company – what would make you want to buy into it?

One of the biggest challenges of preparing for an exit is for the maturing process of the company not to kill the energy of a start-up and the innovation. So, you need to delegate properly and strategically. Focus should not be taken away from the actual work of the company, day-to-day operations need to carry on flowing smoothly, fundraising must continue and customers must be taken care of; you can’t afford to let the ball drop. You must remember that the reason you are an attractive exit acquisition is because you have built a great product, company, and technology.

At the end of the day, exiting is only one option for the future of your company. As has traditionally been done, you can grow your company and become a leader in your industry – after all even the largest of companies were start-ups at one point in time faced the same juncture.

Noor Sweid is the founder and a general partner at Global Ventures and has written this article as a guest writer for MAGNiTT.